Navigating the intricate web of healthcare insurance can often be daunting. This is particularly true when attempting to understand coverage for specific procedures, such as gastric bypass surgery. But don’t worry – we’re here to help. This comprehensive guide will shine a light on the critical aspects of insurance coverage for gastric bypass surgery in Dallas, aiming to simplify this complex topic.

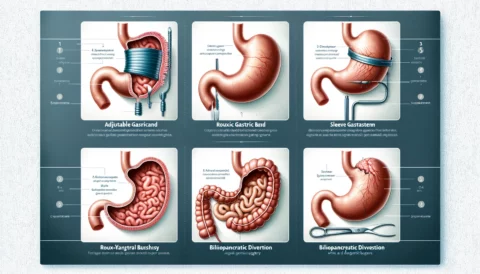

Understanding Gastric Bypass Surgery

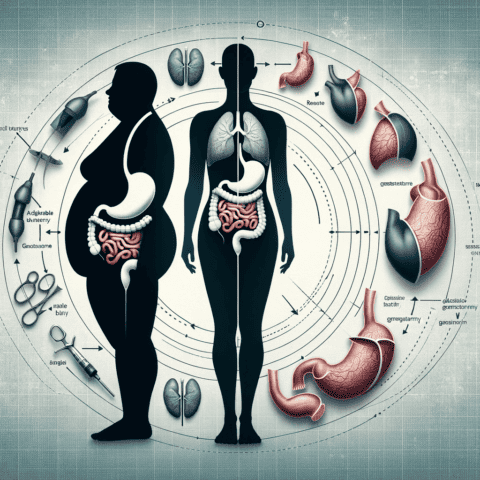

First and foremost, it’s essential to understand what gastric bypass surgery entails. This weight-loss surgery involves reducing the size of your stomach and rerouting your digestive system. The result is that you’ll feel full sooner, eat less, and thus lose weight more efficiently. Gastric bypass surgery is typically considered for those with a body mass index (BMI) over 40 or those with a BMI over 35 who also have obesity-related health conditions such as type 2 diabetes, heart disease, or sleep apnea.

The Role of Insurance in Gastric Bypass Surgery

The complex nature of gastric bypass surgery means it doesn’t come cheap. Here’s where insurance comes into the equation. A robust insurance policy can substantially alleviate the financial burden associated with this life-altering surgery. However, the specifics of coverage can vary considerably depending on your insurance provider and the details of your individual policy.

Navigating Insurance for Gastric Bypass in Dallas

In Dallas, as in many other cities, there’s a variety of insurance providers offering coverage for gastric bypass surgery. Some common providers include Blue Cross Blue Shield, UnitedHealthcare, and Aetna. Understanding how your specific provider and policy deal with gastric bypass coverage is crucial. Most insurance companies categorize gastric bypass surgery under ‘major medical procedures,’ which usually means they cover a portion of the surgery cost, leaving you responsible for meeting the remaining deductible and out-of-pocket maximums.

Understanding Your Insurance Policy

Understanding your insurance policy might be tricky, but it’s an essential part of the process. This includes knowing your provider’s specific criteria for gastric bypass surgery coverage. These criteria often include body mass index (BMI) requirements, a history of failed weight loss attempts, and sometimes even psychological evaluations. Furthermore, many insurance policies mandate that you provide documentation of a medically supervised diet program. It’s also important to check whether your policy covers post-operative care, which can significantly affect your long-term success and overall health.

Steps to Getting Your Gastric Bypass Covered by Insurance

Getting your gastric bypass surgery covered by insurance typically involves a pre-approval process. This may include compiling necessary medical records, documenting your weight loss history, and even providing consultation notes from your bariatric surgeon. Communication plays a critical role during this process. Stay in close contact with your healthcare providers and your insurance company to ensure everyone is on the same page.

Common Questions about Insurance Coverage for Gastric Bypass

There are often numerous questions when it comes to insurance coverage for gastric bypass surgery. Some people wonder about the extent of coverage, what the potential out-of-pocket costs could be, and what steps to take if their claim is denied. Please remember, your insurance provider is there to help clarify these questions and concerns. It’s essential to be proactive, ask questions, and ensure you fully understand your policy.

Conclusion

While it may seem a bit overwhelming, understanding your insurance coverage for gastric bypass surgery in Dallas is entirely achievable. Equipped with the right information and an open line of communication with your insurance provider, you can navigate this landscape with confidence. After all, your healthcare journey is a collaborative process. You, your healthcare team, and your insurance provider are all integral parts of achieving your health goals.