Bariatric surgery can be a life-changing solution for those struggling with obesity and related health conditions. However, the cost of surgery can be a significant concern for many patients. Fortunately, most insurance plans cover weight loss surgery, but navigating the process can be challenging. This comprehensive guide will help you understand the ins and outs of insurance coverage for bariatric procedures, such as gastric sleeve and gastric bypass, and provide practical advice on how to secure coverage for your surgery.

Step 1: Understand Your Insurance Plan

Not all insurance plans are created equal, and the extent of coverage for weight loss surgery can vary significantly between providers and policies. To determine if your insurance covers bariatric procedures, start by reviewing your policy documents or contacting your insurer’s customer service. Be sure to ask about:

- Specific weight loss procedures covered

- Exclusions or limitations related to bariatric surgery

- Criteria for eligibility, such as BMI, comorbidities, or documented weight loss attempts

- Any required pre-surgery evaluations or consultations

Step 2: Meet Your Insurer’s Eligibility Criteria

Most insurance companies require patients to meet specific criteria before approving coverage for bariatric surgery. These requirements often include:

- A body mass index (BMI) of 40 or higher, or a BMI of 35 or higher with at least one obesity-related comorbidity, such as type 2 diabetes, hypertension, or sleep apnea

- A documented history of unsuccessful weight loss attempts through diet, exercise, or medically supervised programs

- Completion of a psychological evaluation to assess your mental health and readiness for the lifestyle changes required after surgery

- Consultation with a registered dietitian to evaluate your nutritional habits and adherence to a prescribed diet

By meeting these criteria, you can demonstrate to your insurer that bariatric surgery is medically necessary and improve your chances of obtaining coverage.

Step 3: Choose the Right Bariatric Procedure

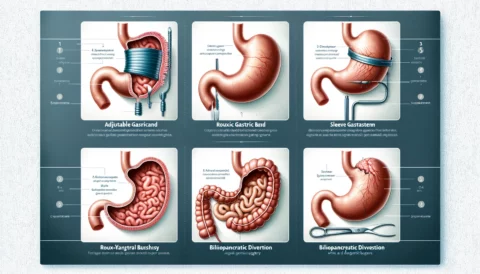

There are several types of bariatric surgery, each with its advantages and disadvantages. It’s essential to work closely with your bariatric surgeon to determine the best procedure for your specific needs and goals. Some of the most popular options include:

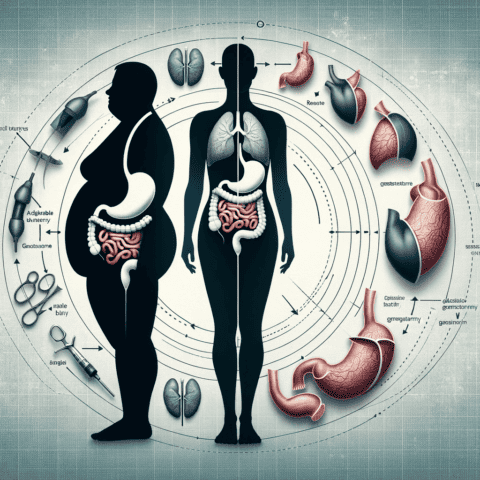

- Gastric sleeve: This procedure involves removing a portion of the stomach, leaving a smaller, sleeve-like structure that restricts food intake and helps patients feel fuller faster. Gastric sleeve surgery is popular due to its relatively low complication rate and significant weight loss results. Learn more about the gastric sleeve procedure here.

- Gastric bypass: Often considered the “gold standard” of bariatric procedures, gastric bypass involves creating a small stomach pouch and rerouting the small intestine to bypass a portion of the digestive tract. This surgery not only restricts food intake but also reduces calorie absorption, leading to significant weight loss and improvement in obesity-related conditions. Find out more about gastric bypass here.

- Gastric revision: For individuals who have not achieved their desired weight loss goals or experienced complications after a previous weight loss surgery, gastric revision may be an option. This surgery can resolve issues such as abdominal hernias or malnutrition and improve the patient’s overall quality of life. Discover more about gastric revision surgery here.

It’s crucial to consider your insurance provider’s coverage for each procedure, as some plans may only cover specific surgeries or require additional documentation to justify the chosen procedure.

Step 4: Obtain Necessary Referrals and Documentation

Before submitting your insurance claim, ensure you have all the necessary referrals and documentation. This often includes:

- A referral from your primary care physician (PCP) recommending bariatric surgery

- Comprehensive medical records outlining your history of obesity and related health conditions, as well as previous weight loss attempts

- Documentation of your pre-surgery evaluations, such as psychological assessments and nutritional consultations

Having all your documents organized and ready to submit can expedite the approval process and minimize the chances of delays or denials due to missing information.

Step 5: Submit Your Insurance Claim

Once you have met the eligibility criteria, chosen the right bariatric procedure, and gathered all necessary documentation, it’s time to submit your insurance claim. Your surgeon’s office can often assist with this process, as they are experienced in working with insurance companies and can help ensure your claim is submitted correctly.

Be prepared for a waiting period, as insurance companies may take several weeks or even months to review your claim and make a decision. Stay proactive during this time by following up regularly with your insurer and addressing any additional information or documentation requests promptly.

Step 6: Appeal a Denied Claim, if Necessary

If your insurance claim is denied, don’t lose hope. Many patients successfully appeal denied claims by providing additional documentation or clarification to their insurer. Review the denial letter carefully to understand the reason for the denial and work with your surgeon’s office to gather any additional information required to address the insurer’s concerns.

Appealing a denied claim can be time-consuming and frustrating, but perseverance can pay off, ultimately leading to insurance coverage for your life-changing bariatric surgery.

Step 7: Plan for Out-of-Pocket Expenses

Even with insurance coverage, you may still be responsible for some out-of-pocket expenses, such as copayments, deductibles, and coinsurance. Be prepared to cover these costs and consider discussing financing options with your surgeon’s office if needed. Additionally, some post-surgery expenses, like vitamins, supplements, and follow-up care, may not be covered by insurance, so plan accordingly.

In conclusion, navigating the world of insurance coverage for weight loss surgery can be challenging but achievable with the right guidance and perseverance. By understanding your insurance plan, meeting eligibility criteria, choosing the best bariatric procedure for your needs, and diligently following the steps outlined in this guide, you can secure coverage for your life-changing surgery and embark on a healthier, happier future. For more information about weight loss surgery options, visit Peak Bariatric’s website.